[Update 4/21/20 – Though the program is out of money, Paypal is still accepting applications here as they anticipate more money coming. They say, “We are hopeful that Congress will allocate additional funds for the program and we will continue to accept new Paycheck Protection Program loan applications in anticipation of additional funding being designated for the program.”]

[Update 4/16/20 – The Paycheck Protection Program is now out of money and applications are no longer being accepted.]

With so much to grieve right now, it is hard to sort through the massive amount of information on the stimulus bill. No doubt, you have received multiple emails with general info about how this might apply to piano teachers. But we wanted to dive deeply into the details of the bill and let you know some details we found that can specifically help you.

First, the stimulus bill is full of benefits that are supposed to help many citizens in many ways. It’s been written about widely and you should read up on how it might work for you. [If you are a Canadian teacher, this might help.] MTNA and broader business press have all written overview articles about multiple facets of the bill. But after looking at these and others, we still couldn’t answer one simple question.

Can a solo piano teacher with a typical studio take advantage of the forgivable loan programs from the SBA?

We dug in to find out.

First, the SBA has published the interim final rule for the forgivable loan program as of April 2, 2020 and it is the most detailed information that seems to be available at this time.

So, what do we know now? Should you or should you not apply for a forgivable PPP loan or the EIDL $10,000 grant/loan as a sole proprietor?

Am I a Sole Proprietor?

First let’s define what we mean by that term “Sole Proprietor”. A sole proprietor is “A business that legally has no separate existence from its owner. Income and losses are taxed on the individual’s personal income tax return”. So, it’s pretty safe to assume that many music and piano teachers reading this are filing their taxes without an LLC or other company of some type.

[If you have formed a company that is an LLC or S-Corp elected entity of some kind, we would urge you to contact your accountant or attorney as you are somewhat more likely to have access to that kind of advice–although we may be able to write more about that later or see the Compose Create Webinar on that topic.]

So, if you file a tax return and attach a Schedule C to your personal income tax return for business expenses, read on. Looking at the guidance from the SBA here is what we found.

First, the stimulus bill provides for the forgivable loan (it’s called the Paycheck Protection Program – we’ll call it PPP from now on) to apply to you as a sole proprietor, not just to larger “small” businesses!

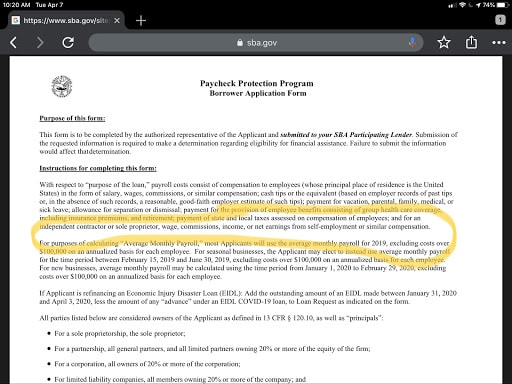

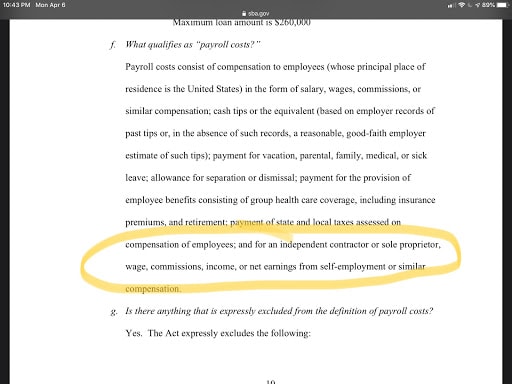

You can read and see this in the PPP Borrow Application form instructions that is on the SBA website. It clearly says “income, or net earnings from self-employment or similar compensation”. So far, so good. You don’t need to do a W2 for yourself to take advantage of this benefit.

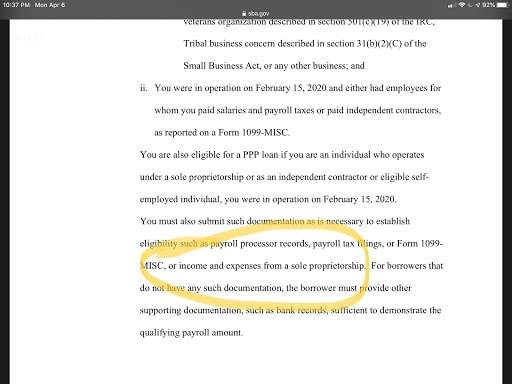

Also, in the SBA Agency Rule for the PPP for the Code of Federal Regulation (pre-published version from the SBA), concerning the PPP, we find these nuggets:

Also there is this:

While you may want to read the whole thing if you struggle with insomnia, these two sections highlight the potential for sole proprietors and the PPP.

So should you apply?

Well, that depends on some additional factors. The amount that can be borrowed and would be ultimately forgivable will vary depending on your income last year (2019, although in some cases it’s possibly 2018). So, you will need to do some math.

[For the whole scoop see the SBA Rule PDF at page 8 letter “e” called “How do I calculate the maximum amount I can borrow?”]

But in short, the formula (subject to the restrictions in the official rule) is if you made $50,000 (net, meaning after all expenses) as a music teacher last year and you filed a tax return with your Schedule C attached showing that $50,000, you can do some quick math to see what you should or may do.

Divide $50,000 by 12 to determine your monthly average ($4,166.67). Then multiply by 2.5 for a total of $10,416.68. Why 2.5? Well, because that 2.5 months of income or “pay-roll” is the initial time period the congress determined would be addressed by the stimulus. So, in this example (there are more in the SBA Rule), the amount you could borrow would be $10,416.68.

So, if (1) the interest rate is low (“[the] loan has a maturity of 2 years and an interest rate of 1%.” per this.), and (2) the loan is forgivable (subject to an application and guidance that isn’t yet published yet See SBA Rule at P 14, last sentence), would this make sense for you?

We’ll get to that.

First, you should know that Sole Proprietors can apply starting April 10th, 2020. So if you even think you are going to apply, download and fill out the SBA Application form and contact your bank to see if they participate in the SBA’s programs or are in the process of becoming an SBA lender. That may be the hardest part of this–if your bank doesn’t have time for you or know about this, you might also need time to find a new bank.

In any event, you should know that PPP can only be used for certain things as provided for in the PPP program overview and materials on the SBA website. But, noting the examples found above, self-employed income is being treated as “payroll” and thus is seemingly an acceptable use of the loaned funds.

EIDL Program – “Economic Injury Disaster Loan Emergency Advance”

That brings us to the EIDL Program where you can borrow directly with the SBA and have up to $10,000 function as a grant and essentially be forgivable. Naturally, if you borrow more, the amount that is over $10,000 will still be owed back under the terms of the program. (Go here to apply directly with the SBA. The link is near the bottom of the page.)

Note that we have not applied for EIDL or talked to any applicants about the process as of this time so we can’t tell you how hard or easy it is. Also, the EIDL is processed directly with the SBA, so the process may be better or worse than working with your bank. This is a huge program and the banks and the SBA weren’t expecting this.

Decision Time

But that brings us back to the example based on $50,000 net income from above. In that case, the PPP borrowing amount is only $416.68 more than the EIDL amount. And, there will be a bit of interest on the PPP even at 1% so the difference is even lower. Plus, in this example the PPP rules for forgiveness aren’t written yet and you have to find and potentially form a relationship with an SBA lender (preferably by the 10th of April 2020).

So in our example, why not try the EIDL for what would be in essence a $10,000 grant? In this case, that makes good sense.

A couple of points to note. First, the PPP application will require you to disclose if you have applied for the EIDL Program because that will reduce your PPP loan amount by $10,000. So in our example, your PPP amount would be just $416.68–maybe not worth the trouble when you factor in the interest cost and other challenges described above. Thus, the reason to skip straight to the EIDL at $50,000 net income amount is apparent and simpler, not accounting for any potential delays at the SBA.

Suggested Decision Process

Here are a few thoughts about how to proceed with all this information.

Step 1: If your net income as a sole proprietor is $50,000 or less you will do just as well to use the EIDL process and potentially save some of the difficulty of working to find an SBA lender. [Update as of 6/9 11:00 a.m.: We are hearing some rumors that the EIDL grant will be limited to $1,000 per “employee” but we have not been able to confirm that from the SBA directly. Obviously, if that proves to be true, the decision we described above would be affected as it’s unlikely that any sole proprietor/teacher would be counted as anything other than a single employee. Meaning that the $10,000 amount could only be $1,000. Thus the steps we described above would make the PPP a better option economically. Update as of 6/13: We did speak with someone who heard from someone who works directly with the SBA in helping people get loans and they did confirm that the grant portion of the loan is now limited to $1,000 per “employee” which means that based on the steps we described above, the PPP would be a better option for the sole proprietor. Of course, all this can change within hours, but that is our understanding as of today.]

Step 2: If your net income is between $50,000 and $100,000 (the limit under the SBA PPP Rule), you should consider the PPP and pursue it since the amount of forgivable aid would be larger up to the maximum for a sole proprietor (($100,000/12)*2.5 = $20,833.33).

Note: Of course some might think to do both the EIDL and the PPP, but that is beyond the scope of this article and at least what we are reading seems to indicate that you aren’t supposed to get both amounts as the EIDL amount will definitely get excluded from the PPP amount per the PPP application.

Again the links, PPP start here and EIDL start here. In both cases, focus on the parts directed at borrowers.

A Note About Unemployment

While we haven’t discussed it, unemployment insurance was previously unavailable to sole proprietors. It’s our understanding that under federal modifications to unemployment programs, most if not all states are now allowing sole proprietors to apply for and receive unemployment benefits through their state programs. Please consult your state unemployment insurance website for details. Before this stimulus program, sole proprietors have not been able to apply for unemployment, but this has seemingly changed. So this opportunity could be easily overlooked for those of you in need.

Final Thoughts

Remember, your bank personnel may be working from home, so be patient. Based on discussions we are having as we explore this, you may not see some of these funds for a while or they may be exhausted quickly with high volumes of unemployment applications. So, please act quickly if the PPP or EIDL is right for you. Remember that that April 10th is when the floodgates of applications open for sole proprietors and the PPP.

We are aware that there is a vast difference between sole proprietors and other business types in these programs, so if you have a music school or employ music teachers within your studio this article will not apply in the same ways. Also, we are aware that there are limited amounts of cash coming to qualified taxpayers on an individual basis. However, we weren’t seeing anything specific to the independent music teacher functioning as a sole proprietor so that is why we wrote this article.

Please realize that this is only informational and Compose Create LLC is not advocating for or against any of these programs and the politics behind them. We simply want music teachers to flourish especially in these times of difficulty. So, if you have strong feelings about congress and the administration, rest assured that we do too, but let’s try to focus on helping each other. So, we hope this helps you.

This article was produced with input from various providers to Compose Create LLC: bankers, CPAs and attorneys and we are grateful for their input, but don’t miss this next part.

Our Necessary Disclaimer

We at Compose Create LLC are not your lawyer, accountant, tax preparer, or financial advisor and none of our content, including this article, will substitute for the advice of those valuable providers so please don’t make important decisions without consulting with one or all of those people. What we are providing here is only our opinion of the brand-new government programs that have been launched in great haste and might benefit you. As we have always done here at Compose Create, we are aware of how hard it is to be a music teacher and run your own business and this alert is being provided for you merely to share our perspective. Of course, the SBA and congress may change the particulars of these programs so please don’t rely on this article without doing your own verification.

[Update as of 6/9 11:00 a.m.: We are hearing some rumors that the EIDL grant will be limited to $1,000 per “employee” but we have not been able to confirm that from the SBA directly. Obviously, if that proves to be true, the decision we described above would be affected as it’s unlikely that any sole proprietor/teacher would be counted as anything other than a single employee. Meaning that the $10,000 amount could only be $1,000. Thus the steps we described above would make the PPP a better option economically. ]

[Update as of 6/13: We did speak with someone who heard from someone who works directly with the SBA in helping people get loans and they did confirm that the grant portion of the loan is now limited to $1,000 per “employee” which means that based on the steps we described above, the PPP would be a better option for the sole proprietor. Of course, all this can change within hours, but that is our understanding as of today.]

Yes! I finally understand what is going on! Thank you Wendy for this thorough explanation. 🙂

Wendy,

As always you are there for our benefit!! Whether this applies to me, I don’t know yet, but it wasn’t even on my radar! Thank you for all that you do for piano teachers!

Stay safe!

Hi Wendy! Thanks for the helpful article. Could you tell me if you can still apply if you’re still teaching but have lost some students? Thanks in advance!

Yes, Julia! Our understanding is that you can still apply subject to the usage restrictions!

Thank You Wendy!! I was just thinking about this this morning, wondering if I would be eligible. You explained it very well. I’ll do my research. Thanks again!

I looked into PPP from my Wells Fargo bank, but they are not accepting applications from those who did not have a pre-existing Small Business account since before the pandemic.

So will have to apply at some other bank. In the meantime have also applied for unemployment. Half my income is performing as a 1099 freelance worker, all those concerts are cancelled. And I can’t teach virtually due to technical difficulties, nobody able to solve them for me (and I can’t figure it out, but for starters my laptop doesn’t have a camera).

Thank you for your time and research and sharing of this article. It is full of helpful and timely information. Mentioning “strong feelings“ regarding our administration was not necessary or beneficial though at this difficult time. Thank you again for the article.

Thank you so much for the information! I enjoy your articles and have found them to be very useful.

Thank you! I went ahead and applied – wish me luck!

Hi,

Thank you so much for doing this research. I just want to clarify that, as of now, none of these are guaranteed grants and all of these are loans that would need to be paid back. There is a possibility that PPP will be forgiven, but there isn’t the information detailing what the criteria for that would be? Is that correct?

(I’m only interested if I can receive money WITHOUT needing to pay it back.) Thanks!

Cheryl, Teaching by phone works just fine. It really zeros into our aural skills. The ear training is essential in many music aspects! Three-way communication works well with parent, student & teacher. The parent can facilitate by writing lesson assignments which saves time I have found; especially when I need to include a note! I notice the increased parent involvement which can be a plus!

I have an idea numbers of students will be in flux since many parents are definitely losing full-time or part-time wages. Changes are indeed rapid.

Hi Teachers, Stay well!

Carol

Wendy, I know you are not our lawyer, CPA,

investment rep., etc. BUT YOU ARE OUR FRIEND and I appreciate you so very much!

Plus, I love your compositions!????????

My heart goes out to Cheryl, as I am in a similar situation. Performance income has come to a grinding halt, and teaching via Skype is exhausting and headache producing—even without technical difficulties. I’ve already lost two students due to their parents sudden unemployment status. Im still grateful to be alive and so far healthy, but the uncertainty of how to pay for said health and maintenance is disturbing at the least. Thanks for this forum for sharing, Wendy.

How kind of you to do all this homework for us at such a confusing time. This really clarifies the different programs and the obstacles involved. Wendy, you really are a gem and always thinking of us. That having been said, I actually have an LLC but am the only teacher, so not sure how this all fits me.

Hi April,

It is my understanding that you definitely can apply with an LLC!

Hi Monique,

Sorry I missed your comment and question a few days ago! Thanks for your kind words about the article. I’m glad it was helpful.

Regarding what makes it forgivable, I can only tell you what the SBA tells you here: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program-ppp#section-header-5

I’ll quote what it says as of 4/14:

Loan Details and Forgiveness

The loan will be fully forgiven if the funds are used for payroll costs, interest on mortgages, rent, and utilities (due to likely high subscription, at least 75% of the forgiven amount must have been used for payroll). Loan payments will also be deferred for six months. No collateral or personal guarantees are required. Neither the government nor lenders will charge small businesses any fees.

“Forgiveness is based on the employer maintaining or quickly rehiring employees and maintaining salary levels. Forgiveness will be reduced if full-time headcount declines, or if salaries and wages decrease.

This loan has a maturity of 2 years and an interest rate of 1%.

If you wish to begin preparing your application, you can download a copy of the PPP borrower application form to see the information that will be requested from you when you apply with a lender.”

I hope that helps!